EVI Industries Reports Mixed Q3 Results with Record Cash Flows Amid Revenue Decline

Record Operating Cash Flow: Achieved a record $20.3 million for the nine-month period, marking a $2.7 million increase year-over-year.

Net Debt Reduction: Net debt decreased by 36%, from $28.9 million to $18.6 million within the nine-month period.

Revenue: Reported a decline of 11% in third-quarter revenue, primarily due to irregular industrial revenue and delays in large customer sales.

Net Income: Third-quarter net income was $956K, down from $2.75 million in the same period last year.

Investments in Technology: Increased investment across key technology initiatives aiming to transform into a modern, data-driven company.

Acquisition: Acquired ALCO Washer Center, enhancing market share in the northeast region of the United States.

Dividends: Paid a special cash dividend of $0.28 per share during the second quarter of fiscal 2024.

EVI Industries Inc (EVI), a prominent distributor and service provider in the commercial laundry and dry cleaning equipment sector, disclosed its financial results for the third quarter and nine-month period ended March 31, 2024. The detailed financial performance, revealed in its 8-K filing, highlighted a mix of record-setting cash flows and a dip in quarterly revenue. The company's strategic focus remains on long-term growth through technological advancements and market expansion.

Based in Miami, Florida, EVI Industries operates through its subsidiaries, offering a comprehensive range of products and services tailored to the commercial, industrial, and institutional sectors in North America and beyond. The company's offerings include sales, leasing, and rental of equipment, as well as maintenance and design services, making it a key player in its industry.

Financial Performance Overview

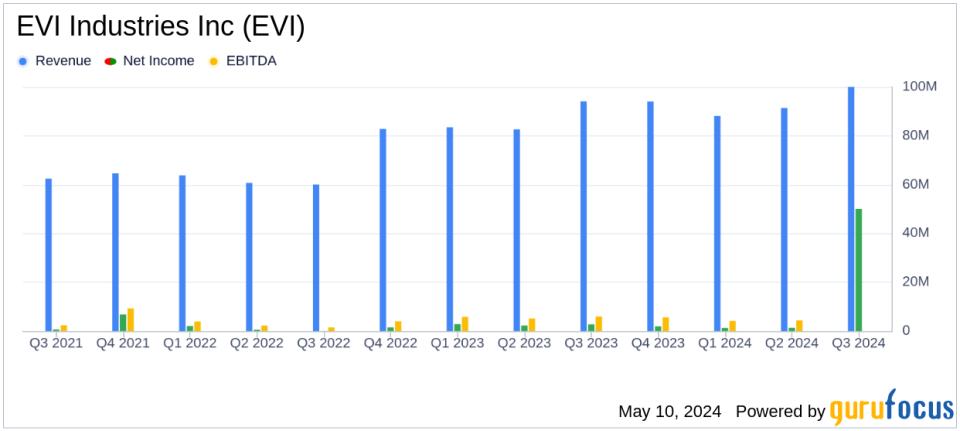

The third quarter showed a revenue decline of 11% year-over-year, falling to $83.979 million from $94.066 million. This decrease was primarily due to the irregular timing of revenue from large industrial projects, which overshadowed an otherwise incremental growth in equipment, parts, and service revenue. Despite this, the nine-month period still boasted a record $20.3 million in operating cash flows, a significant increase from the previous year, and a reduction in net debt by 36%, enhancing the company's financial stability.

The company reported a gross margin of 30.7% for the quarter, reflecting a robust profitability level in its operations. However, the substantial investments in sales and service personnel, crucial for long-term growth, have temporarily impacted operating results. Net income for the quarter stood at $956,000, a decrease from $2.750 million in the prior year's comparable period.

Strategic Investments and Technological Initiatives

EVI Industries has been proactive in its long-term strategy, focusing on technological innovation and market expansion. The acquisition of ALCO Washer Center during the period under review is a testament to its ongoing efforts to enhance market share and integrate advanced technologies into its operations. This strategic move is expected to strengthen EVI's presence in the Northeastern U.S. market.

The company's technology strategy, initiated in 2020, aims to transform EVI into a data-driven entity capable of sustaining competitive advantage through enhanced operational efficiencies and customer service. Investments in Enterprise Resource Planning (ERP) systems and customer-facing technologies are anticipated to drive future growth and profitability.

Challenges and Forward-Looking Statements

While EVI continues to navigate through the complexities of irregular industrial revenue cycles and extensive investment phases, its strong cash flow position and strategic acquisitions provide a solid foundation for future growth. The company remains focused on expanding its market share and enhancing shareholder value through innovative strategies and operational excellence.

For more detailed information on EVI Industries' financial results, including the full commentary on its operations and strategic initiatives, stakeholders are encouraged to review the company's quarterly report on Form 10-Q for the quarter ended March 31, 2024, as filed with the SEC.

EVI Industries' commitment to maintaining a robust financial structure while investing in growth initiatives highlights its potential to navigate through current challenges and capitalize on long-term opportunities within the commercial laundry industry.

Explore the complete 8-K earnings release (here) from EVI Industries Inc for further details.

This article first appeared on GuruFocus.