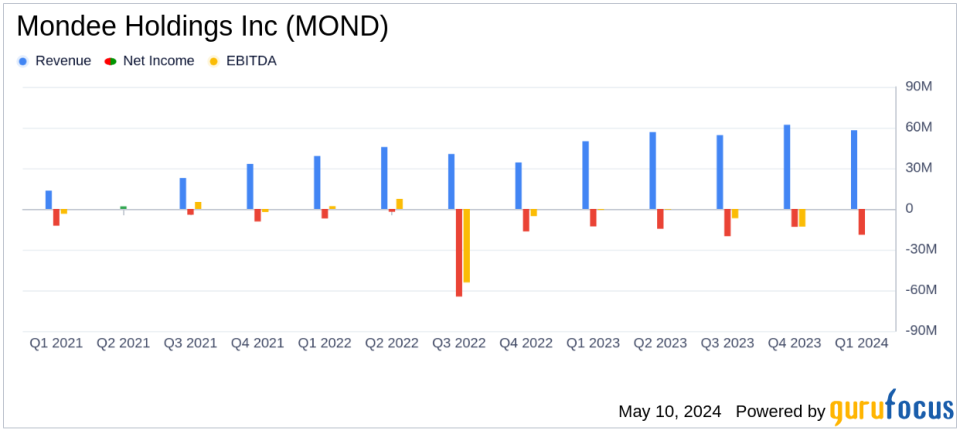

Mondee Holdings Inc (MOND) Q1 2024 Earnings: Revenue Surpasses Estimates, Net Loss Widens

Revenue: Reported $58M, a 16% increase from the previous year, exceeding estimates of $55.23M.

Net Loss: Posted a net loss of $19.5M, significantly higher than the estimated loss of $11.31M.

Earnings Per Share (EPS): Recorded a loss of $0.30 per share, falling short of the estimated loss per share of $0.11.

Adjusted EBITDA: Achieved $5.1M, marking a 27% increase year-over-year and indicating operational efficiency improvements.

Operating Cash Flow: Generated $18.7M, a substantial improvement from a cash use of $10.0M in the same quarter last year.

Gross Bookings: Increased by 6% to $708M, reflecting robust demand and expansion in service offerings.

Guidance: Raised 2024 net revenue guidance to between $250M and $260M, anticipating continued growth.

Mondee Holdings Inc (NASDAQ:MOND) released its 8-K filing on May 10, 2024, unveiling its financial results for the first quarter of 2024. The company reported a significant 16% increase in net revenues, reaching $58 million, surpassing the estimated $55.23 million. However, the net loss expanded to $19.5 million, a 51% increase from the previous year, influenced by various non-cash and non-recurring items.

Mondee Holdings Inc, headquartered in Austin, Texas, operates as a prominent travel marketplace and artificial intelligence technology company. It serves both leisure and corporate sectors through its innovative AI platforms and technologies. The company's primary revenue streams are generated from its Travel Marketplace segment, which involves selling airline tickets through its proprietary platform.

Financial and Operational Highlights

The first quarter saw Mondee achieving a gross booking of $708.1 million, a 6% increase year-over-year. This performance was underpinned by a notable 62% increase in transactions, highlighting the company's expanding market presence. Despite the higher revenue, Mondee's net loss deepened due to $20.7 million in non-cash and non-recurring costs, including depreciation, amortization, and stock-based compensation.

Adjusted EBITDA for the quarter stood at $5.1 million, up by 27% from the previous year, reflecting improved operational efficiency. The operating cash flow turned positive at $18.7 million, a significant improvement from a cash use of $10 million in Q1 2023. This indicates stronger cash flow management and operational execution.

Strategic Developments and Future Outlook

Mondee's strategic initiatives, including post-acquisition synergies and the extension of its term loan maturity, have positioned it for sustained growth. The company has raised its net revenue guidance for 2024 to between $250 million and $260 million, anticipating a 14% increase at the midpoint compared to 2023. Adjusted EBITDA is also expected to rise significantly, by up to 67% at the midpoint.

The company's robust technological foundation and innovative AI capabilities continue to drive its market expansion and enhance its service offerings, promising further growth in the competitive travel and leisure industry.

Investor and Analyst Perspectives

While Mondee's revenue growth and strategic expansions paint a positive outlook, the widened net loss and significant non-cash expenses may concern investors focused on near-term profitability. However, the strong increase in operating cash flow and positive adjustments in EBITDA suggest effective management actions towards long-term financial health and operational stability.

Mondee Holdings Inc remains a key player in the travel technology landscape, with its innovative solutions and strategic market expansions setting the stage for potential future gains. Investors and stakeholders will likely watch closely how the company's strategies unfold in the upcoming quarters.

For further details on Mondees financial performance and strategic initiatives, please refer to their Investor Relations website.

Explore the complete 8-K earnings release (here) from Mondee Holdings Inc for further details.

This article first appeared on GuruFocus.